In a September 8 post on his campaign Facebook page, District 6 candidate Hari Lal opined “We pay the highest amount of property and city taxes here [in District 6].”

Except that Lal hasn’t been paying any property taxes, according to the Orange County Treasurer-Tax Collector.

Lal is an attorney and Anaheim Hills resident who is running for Anaheim City Council because he is “angry about corruption” and doesn’t think District 6 residents are getting a good return on the taxes they pay.

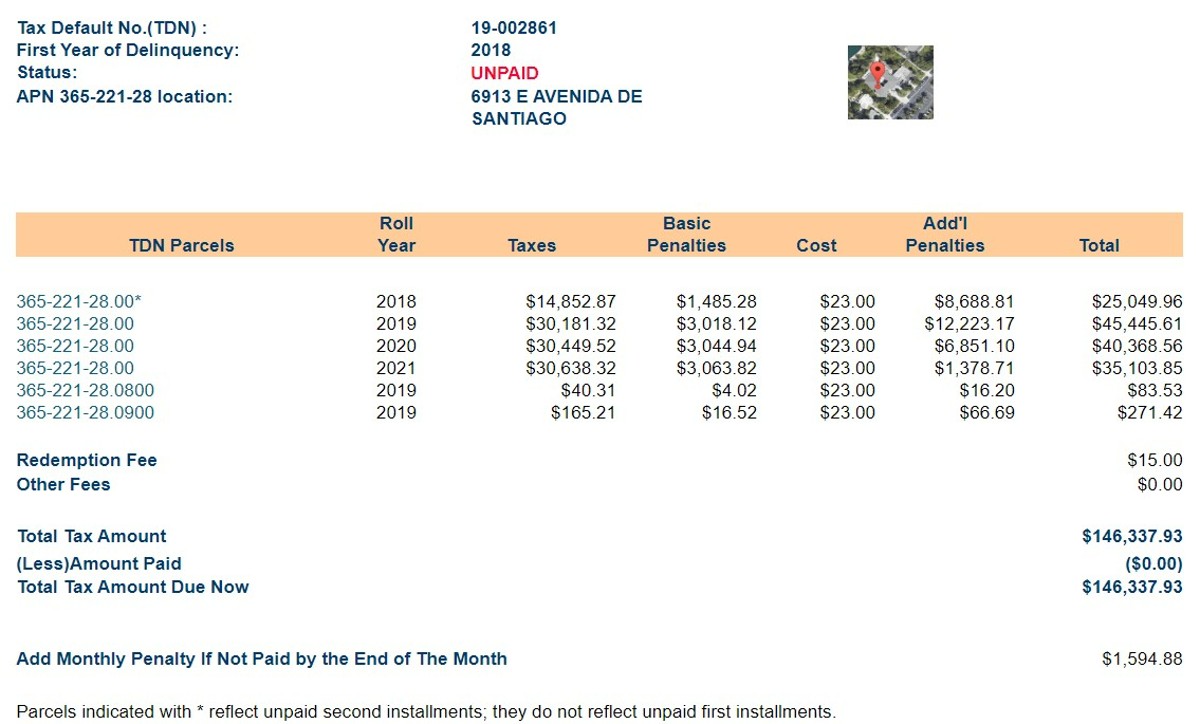

However, Lal hasn’t paid property taxes on his home since February 2019 and owes $146,337.93 in delinquent property taxes, according to the Orange County Treasurer-Tax Collector’s website:

Lal is a Democrat and has been endorsed by the Democratic Party of Orange County.

According to online real estate sites Realtor.com and Redfin.com, Lal’s home is a 5,037 square foot house with 7 bedrooms and 5.5 bathrooms on a 1-acre lot, with an estimated re-sale value of $1.9 to $2.3 million.

According to the OC Treasurer-Tax Collector, Lal is delinquent on property taxes for 2018 through 2021. The home has a total assessed value of $1,944,337, according to the county.

Prior to the original publication of this article, I e-mailed Mr. Lal regarding the delinquent taxes, asking for his comment on whether or not he disputes the accuracy of the OC Treasurer-Tax Collector website, and how a massive, multi-year property tax delinquency squares with his “cleaning up City Hall” campaign theme.

In a comment posted at 1:19 a.m. on September 14, Lal claimed the “property tax is in dispute with the county of Orange” due to his “pending application” to do a Prop. 19 transfer of base year value. Lal wrote he has a “valid confirmed copy of the petition filed with the county for base tax post the sale of my house in 2019.”

In California, eligible homeowners can transfer the taxable value of their home to a replacement property anywhere within California up to three times.

Voters narrowly approved Prop. 19 in November 2020. The provision under which Lal is allegedly seeking applies to transfers starting April 1, 2021.

I e-mailed Lal yesterday morning (September 14) and requested a copy of the petition. Lal has not responded to the request.

Lal’s Explanation Full Of Inconsistencies And Flaws

There are a number of issues with credibility of Lal’s explanation.

Lal says his property tax delinquency stems from a “dispute” with the county. However, there is no record of any dispute, according to the OC Treasurer-Tax Collector’s office: no correspondence, comments, etc. from Lal. Refusing to pay one’s property taxes is not a legal way to dispute those taxes.

For one thing, Lal has not paid property tax on his Anaheim Hills house since February 2019, according to the OC Treasurer-Tax Collector’s office. Even that payment was two months late.

Yet Lal contends he is delinquent on $146,377 in property taxes due to an application he filed under Prop. 19 – which wasn’t passed until November 2020, and the provision under which Lal has allegedly filed for a base year value transfer didn’t take effect until April 1, 2021. In other words, Lal is saying he stopped paying property taxes on his house on the basis of a proposition that wouldn’t be on the ballot until nearly two years later.

Lal would have to file this application with the Orange County Assessor. However, the Assessor’s office said they have no record of an application from Lal. The application would have to be mailed into the Assessor office, which told me it can take one to two months for it to be entered into the system.

Even assuming Lal’s application has been sitting on the desk of an Assessor’s office employee for a month or two, he has not paid property taxes on his house since early 2019.

“He still owes the taxes,” said the Treasurer-Tax Collector employee with whom I spoke.

Lal also wrote that he filed the application “post the sale of my house in 2019.” However, records show he has owned his current residence since 2015. In August 2015, the house was purchased by the Ramp Family Trust, the trustees of which are Purnima and Hari Lal. In June of 2017, the property was transferred from the trust to Hari and Purnima Lal as joint tenants.

The Prop. 19 application Lal claims to have filed must meet the following criteria:

- The original primary residence must be sold.

- The original primary residence must have been your principal place of residence (thus, eligible for the homeowners’ or disabled

veterans’ exemption) either (1) at the time of sale, or (2) within two years of the purchase of your replacement primary residence. - The replacement primary residence must be purchased or newly constructed within two years of the sale of the original primary

residence. - Claimant must own and occupy the replacement primary residence as a principal place of residence (thus, eligible for the homeowners’ or disabled veterans’ exemption) at the time this claim is filed.

- Either (1) the sale of the original primary residence or (2) the purchase or completion of new construction of the replacement primary residence must occur on or after April 1, 2021.

As noted, Lal has owned his current residence – where he is registered to vote and certified as a member of the GHAD Board of Directors – since August 2015. That puts it outside the window for using Prop. 19 to transfer the base year value from wherever he lived before then to the house on which has hasn’t been paying his property taxes.

If Lal is trying to transfer the base year valuation of his Avenida de Santiago house to a replacement primary residence, then the latter must be his principal residence – as in where he is registered to vote, for example. According to records, Lal is registered to vote at his Avenida de Santiago house.

Furthermore, assuming Lal has submitted a base year value transfer application – that is not a justification for not paying property taxes. If such an application were approved and the Assessor lowered the assessed valued of the property, the property owner would get a refund of the difference. In a case such as Lal’s, any refund would be applied to delinquent taxes – and would be unlikely to cover a property tax delinquency the size of Lal’s.

Yesterday afternoon, I again e-mailed Lal a number of questions seeking clarification and additional information regarding his claims and explanations, but have received no responses. The article will be updated when and if Lal responds.