A union-sponsored ballot measure campaign to impose a 3% gross-receipts tax on for-profit Anaheim hospitals – which critics contends will increase patient costs while narrowing their health care options – submitted 27,479 signatures to the City Clerk’s Office, which as turned them over to the OC Registrar of Voters for verification.

16,788 valid Anaheim voter signatures are necessary to qualify the initiative for the November 2024 ballot.

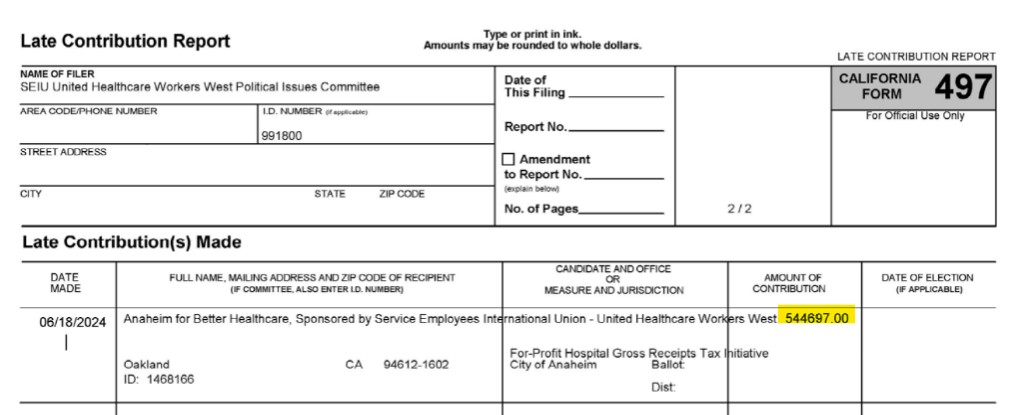

The hospital tax measure is sponsored by the powerful Service Employees International Union-United Healthcare Workers West, which has spent more than half a million dollars on the ballot measure campaign thus far.

The Anaheim City Clerk’s office received the signatures on Jun 4 and, following a prima facie review, turned the signatures over to the OC ROV on June 10 for signature verification, which must be completed within 30 business days – or July 30. The ROV reports the number of valid signatures to the City Clerk, who either deems the petition insufficient or issue a Certificate of Sufficiency to present to the City Council for decision on how to proceed.

The clock is ticking on any hopes of placing it on the November 2024 ballot. If it qualifies, the Anaheim City Council votes to either adopt it as an ordinance or place it before the voters. While the deadline for placement on the November ballot is August 9, the last scheduled council meeting prior to that deadline is July 23 (although the mayor has the option of calling a special council meeting).

SEIU-UHW ballot measure would impose a 3% “gross receipts” tax on for-profit hospitals operating in Anaheim. The tax would apply to the share of the hospital owners revenue generated in either Anaheim or statewide.

READ: SEIU Behind Ballot Measure To Impose Tax On For-Profit Hospitals In Anaheim

The tax would hit any for-profit Anaheim hospital that provides “24-hour inpatient care” that includes “medical, nursing, surgical, anesthesia, laboratory, radiology, pharmacy” services.

There are several Anaheim hospitals that would be subject to such a tax:

- West Anaheim Medical Center

- Anaheim Global Medical Center

- Anaheim Regional Medical Center

- Anaheim Community Hospital

According to the measure’s language, “hospitals subject to the tax could request from the City that the Hospital’s gross receipts be apportioned according to the amount of business activity the Hospital has within Anaheim or the State of California.”

Revenues raised from such a tax would go into the city’s general fund – the initiative makes no mention of unofficially earmarking funds for any particular city service – it’s just more tax revenue for city government.

According to industry sources, the SEIU-UHW has been in contract negotiations with several for-profit hospitals, and the ballot measure serves as negotiating leverage, i.e. “agree to our terms or we’ll put this tax on the ballot.”

Even if it is determined the hospital tax ballot measure has enough valid signatures to qualify for the ballot, there is still a short window within which SEIU-UHW can withdraw the initiative.

According to the notice of intent filed with the Anaheim City Clerk on January 10, 2024, the initiative’s proponent is Darrell Jerome, an SEIU officer who works as a medical assistant for Kaiser Permanente, which has a massive hospital facility in East Anaheim. Kaiser-Permanente is a not-for-profit hospital chain and therefore would not be subject to the 3% gross receipts tax.

Some critics took aim not only at the ballot measure, but at the union powering it – the SEIU-UHW.

“SEIU-UHW’s policy proposals — including this latest ballot measure — are just the tip of the iceberg when it comes to the union’s controversies,” said Charlyce Bozello, communications director for the Center for Union Facts. “Several of the union’s leaders have faced serious sexual harassment allegations, and dozens of employee reviews allege a brutal work environment and even accuse UHW of being anti-union. Before weighing in on UHW’s policies, the public and union members deserve to get the full story on the union’s track record.”

[Editor’s not: an earlier version of this article erroneously stated August 11 as the deadline for placing the initiative on the November ballot. The actual deadline is August 9.]