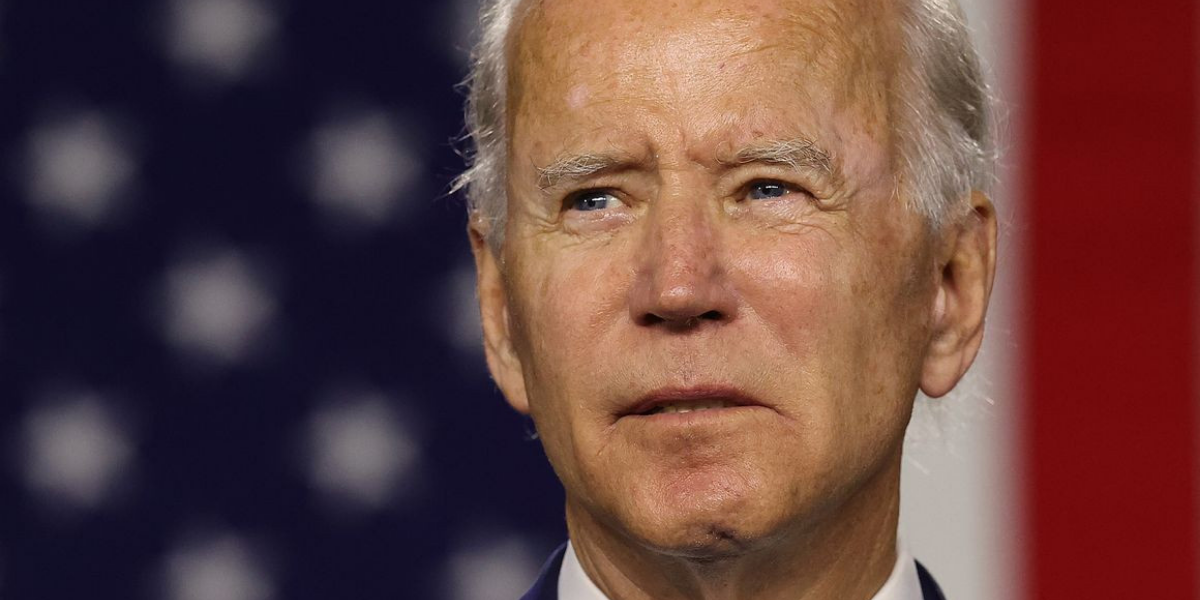

On November 19, the House of Representatives, on a party-line vote, passed HR 5376 – the Biden Administration’s “Build Back Better” spending bill – by a vote of 220-213. Biden’s centerpiece legislation marks the largest single expansion of the federal government since the enactment of President Lyndon Johnson’s Great Society programs in the 1960s.

The total cost of the bill is nominally $2 trillion, based on assumptions that key new entitlement programs will expire before the end of the decade, rather than be made permanent. Historically, federal entitlement programs are almost never eliminated once enacted. Independent budget analysts peg the true cost of Build Back Better at closer to $5 trillion.

Here’s how members of Orange County’s congressional delegation voted on “Build Back Better”:

YES

- Rep. Lou Correa (Democrat)

- Rep. Mike Levin (Democrat)

- Rep. Katie Porter (Democrat)

- Rep/ Alan Lowenthal (Democrat)

NO

- Rep. Michelle Steel (Republican)

- Rep. Young Kim (Republican)

Among the bill’s provisions:

- Creation of a new federal entitlement to taxpayer-funded, universal pre-K education

- Creation of a new federal entitlement to taxpayer-funded child care.

- Mandating businesses to provide at least 4 weeks of paid family leave.

- Grant 10-year legal status to approximately 6.5 million illegal immigrants, whom Rep. Correa calls “the backbone of our country.”

- A $8 billion methane fee – essentially a tax on natural gas production that the American Gas Association estimates will increase the average family’s natural gas bill by 17%.

- Increase the state-and-local tax deduction from $10,000 to $80,000 – a tax cut for wealthy residents of high-tax states.

- Dramatically increase federal subsidies for “green energy,” even though U.S. emissions are declining significantly.

- Allow trial lawyers to deduct expenses from their contingency-fee lawsuits.

“Build Back Better” also expands the earned-income tax credit, increases ObamaCare subsidies, and creates

The bill would also impose an array of pharmaceutical price controls that critics contends would stifle innovation and undermine availability, based on the largely negative history of price controls on the economy.

Contrary to defenders claims that Build Back Better is entirely paid for by huge tax increases and more robust tax collection, there is widespread agreement it will actually add to the already staggering national debt, with budget watchdogs differing primarily on how many hundreds of billions in deficit spending the bill entails.

A broad spectrum of economists have criticized the gargantuan increase in federal spending as inflationary and ill-advised at a time when the inflation rate has surged to a 30-year high, largely wiping out wage gains in recent years. The $2 trillion “Build Back Better” bill comes on the heels of a pandemic-driven explosion in spending by Washington, as total federal outlays grew 47% in 2020 and another 54% in 2021.

Two recent studies have estimate that the massive package of taxation-and-spending increases would result in job losses of between 5.3 million and 8.7 million, with attendant losses in payroll tax revenues running into the hundreds of billions over the next decade. This, in turn, undermines the long-term solvency of the Social Security system, which depends on payroll taxes to fund the benefits of current retirees.