Circulators are gathering signatures in Anaheim for an initiative to impose a 3% tax on the “gross receipts” of for-profit “general acute care hospitals.” The tax would hit any for-profit Anaheim hospital that provides “24-hour inpatient care” that includes “medical, nursing, surgical, anesthesia, laboratory, radiology, pharmacy” services.

There are several Anaheim hospitals that would be subject to such a tax:

Paid signature gatherers began hitting the streets during the past 10 days, according to sources.

According to the measure’s language, “hospitals subject to the tax could request from the City that the Hospital’s gross receipts be apportioned according to the amount of business activity the Hospital has within Anaheim or the State of California.”

Revenues raised from such a tax would go into the city’s general fund – the initiative makes no mention of unofficially earmarking funds for any particular city service – it’s just more tax revenue for city government.

What Is A “Gross Receipts Tax”?

A gross receipts tax levied on the total revenue of a business, without allowing deductions for business expenses such as the cost of goods sold or employee compensation. Put another way, it is a tax on total revenue, not profit. It would be like taxing an individual purely on their income while stripping away all deductions and credits.

Unlike a sales tax, which is applied only to the final consumer purchases, a gross receipts tax is assessed on businesses and applies to business-to-business transactions, as well.

In the context of a for-profit hospital, the gross receipts tax would be applied to the hospital’s total revenue from all sources, including patient services, sales of medical supplies, and any other revenue-generating activities – and any business-to-business transaction taking place in order to provide patient services. This means that the hospital would be taxed on its gross revenue, without being able to deduct the costs of providing those services or selling those supplies.

Gross receipts taxes are regressive and typically passed on to consumers – in this case, patients – in the form of higher costs for services and supplies.

It is unclear at this point who is behind the initiative and what their political and policy motivations and goals are, or why it targets only for-profit hospitals.

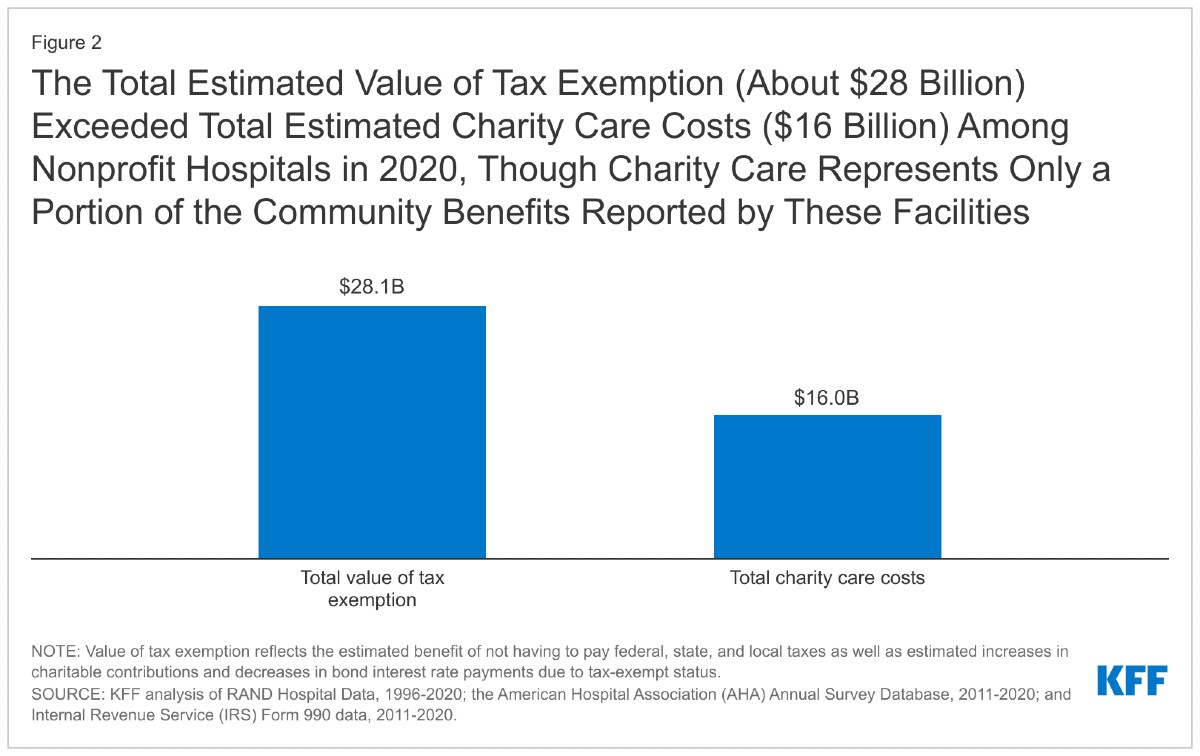

Although non-profit hospitals – which are exempt from paying federal and state income taxes, sales taxes and property taxes – are supposed to provide significant charitable care in return for their non-profit status, recent research found that the value of the tax-exemption significantly exceeded the value of charitable medical services provided – $28 billion to $16 billion.

Another study, published in 2021 found that for-profit hospitals provided 65% more charity care than their non-profit counterparts.